Strategy #3 Implement trust vehicles. you still need income from your assets but want. to move them out of your estate to minimize taxes, adding certain trust vehicles can help. Here are two options: IDIT – Intentionally Defective Irrevocable Trust. GRAT – Grantor Retained Annuity Trust.

Don’t Forget About Washington State’s Estate Tax

lower, Credit Shelter Trusts avoid tax on the first death and assure that both spouses’ estate tax exemptions are available to reduce or avoid estate tax. For many years the exemption was only $600,000, and many couples used Credit Shelter Trusts to collectively exempt $1.2 million of estate tax. In recent years, the exemption amount

Source Image: bethellaw.com

Download Image

To pay the estate tax, send the payment with either a timely filed extension application or the Washington State Estate and Transfer Tax Return. You can make a payment using our My DOR services , or you can mail the payment and form to: Washington State Department of Revenue. PO Box 47474. Olympia WA 98504-7474.

.jpg)

Source Image: nine8redev.com

Download Image

Savvy Estate Planning: Avoid the Top 10 MISTAKES The advantage of an irrevocable trust is that your assets are not seen as a part of the estate, and therefore, not subjected to estate tax. Like the revocable trust, assets in an irrevocable trust are also not subject to probate. Each person will have distinct goals in mind when they set up a living trust. When deciding whether a revocable or

Source Image: buddyins.com

Download Image

Does A Trust Avoid Washington State Estate Tax

The advantage of an irrevocable trust is that your assets are not seen as a part of the estate, and therefore, not subjected to estate tax. Like the revocable trust, assets in an irrevocable trust are also not subject to probate. Each person will have distinct goals in mind when they set up a living trust. When deciding whether a revocable or Also, Washington does not levy gift taxes, and the federal lifetime gift exemption is $11.7 million—the same as the federal estate tax exemption. You can use part of the federal exemption amount to gift assets away to get under the Washington state exemption amount and avoid the state estate tax. Planning For Estate Taxes is Complex

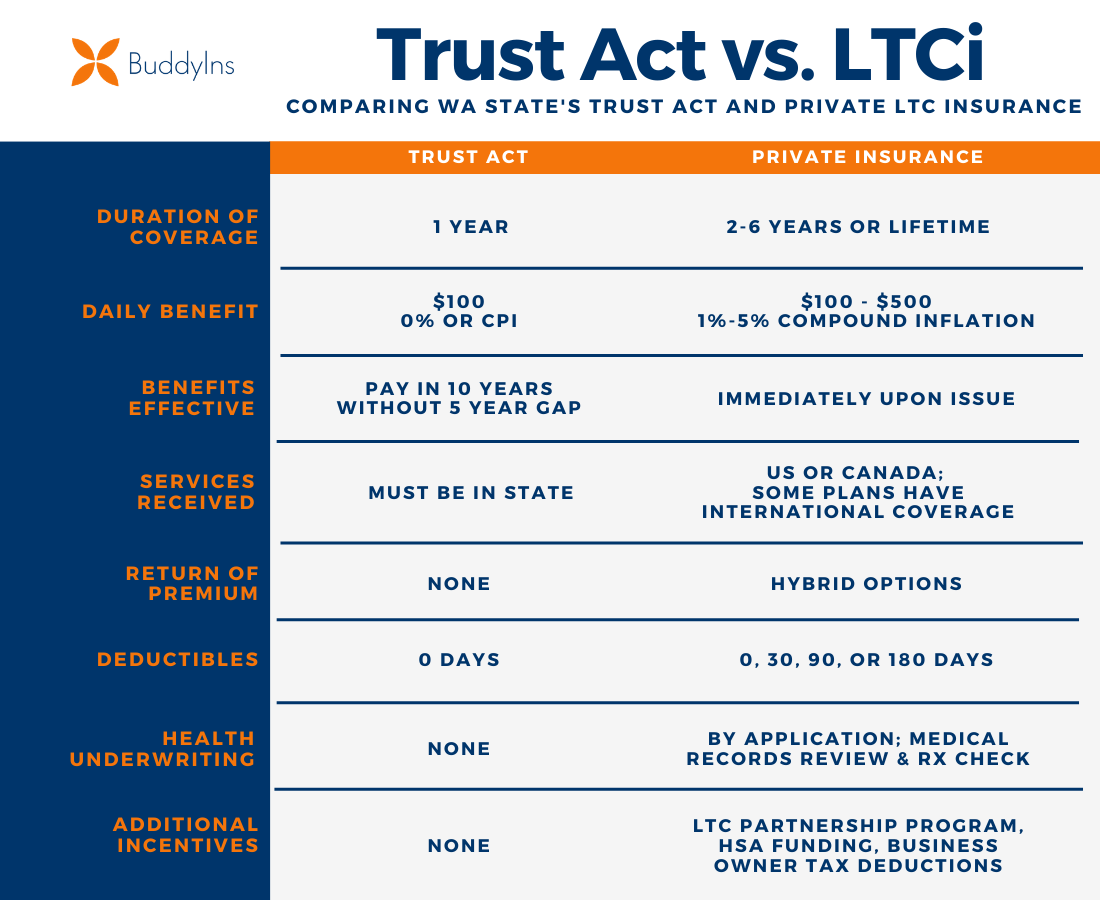

Washington State Trust Act: Should You Opt Out? – BuddyIns

Dec 20, 2023In 2023, the estate tax only applies to estates worth more than $12.92 million for individuals and $25.84 million for married couples. This increases to $13.61 million and $27.22 million, respectively, in 2024. As with all tax brackets, the estate tax applies only to assets above the cap. For example, on an estate worth $13,020,000, the IRS Advanced Trusts & Estates (presented by NYU School of Professional Studies) [Two-Day Event] | myLawCLE

![Advanced Trusts & Estates (presented by NYU School of Professional Studies) [Two-Day Event] | myLawCLE](https://mylawcle.com/wp-content/uploads/2022/07/Advanced-Trusts-Estates-presented-by-NYU-School-of-Professional-Studies_Flat_myLawCLE-676x380.png)

Source Image: mylawcle.com

Download Image

Will vs Trust in Washington State – YouTube Dec 20, 2023In 2023, the estate tax only applies to estates worth more than $12.92 million for individuals and $25.84 million for married couples. This increases to $13.61 million and $27.22 million, respectively, in 2024. As with all tax brackets, the estate tax applies only to assets above the cap. For example, on an estate worth $13,020,000, the IRS

Source Image: m.youtube.com

Download Image

Don’t Forget About Washington State’s Estate Tax Strategy #3 Implement trust vehicles. you still need income from your assets but want. to move them out of your estate to minimize taxes, adding certain trust vehicles can help. Here are two options: IDIT – Intentionally Defective Irrevocable Trust. GRAT – Grantor Retained Annuity Trust.

Source Image: linkedin.com

Download Image

Savvy Estate Planning: Avoid the Top 10 MISTAKES To pay the estate tax, send the payment with either a timely filed extension application or the Washington State Estate and Transfer Tax Return. You can make a payment using our My DOR services , or you can mail the payment and form to: Washington State Department of Revenue. PO Box 47474. Olympia WA 98504-7474.

Source Image: cunninghamlegal.com

Download Image

Avoid Probate; Put Property in a Trust 🏠💸 | Real Estate Investors‼️ If you are buying property to pass on to your loved ones, put your property in a “Trust.” 🏠 Believe The Washington state estate tax, however, has a much lower exclusion amount of $2.193 million for 2020. Because of the lower exclusion amount, many Washingtonians may wish to include tax planning measures in their estate plan to address their potential state estate tax liability even though they do not have any federal estate tax concerns.

Source Image: facebook.com

Download Image

Op-ed: Give from your estate now to reduce your tax exposure later The advantage of an irrevocable trust is that your assets are not seen as a part of the estate, and therefore, not subjected to estate tax. Like the revocable trust, assets in an irrevocable trust are also not subject to probate. Each person will have distinct goals in mind when they set up a living trust. When deciding whether a revocable or

Source Image: cnbc.com

Download Image

Don’t Forget About Washington State’s Estate Tax Also, Washington does not levy gift taxes, and the federal lifetime gift exemption is $11.7 million—the same as the federal estate tax exemption. You can use part of the federal exemption amount to gift assets away to get under the Washington state exemption amount and avoid the state estate tax. Planning For Estate Taxes is Complex

Source Image: linkedin.com

Download Image

Will vs Trust in Washington State – YouTube

Don’t Forget About Washington State’s Estate Tax lower, Credit Shelter Trusts avoid tax on the first death and assure that both spouses’ estate tax exemptions are available to reduce or avoid estate tax. For many years the exemption was only $600,000, and many couples used Credit Shelter Trusts to collectively exempt $1.2 million of estate tax. In recent years, the exemption amount

Savvy Estate Planning: Avoid the Top 10 MISTAKES Op-ed: Give from your estate now to reduce your tax exposure later The Washington state estate tax, however, has a much lower exclusion amount of $2.193 million for 2020. Because of the lower exclusion amount, many Washingtonians may wish to include tax planning measures in their estate plan to address their potential state estate tax liability even though they do not have any federal estate tax concerns.