Watch this video to avoid common pitfalls when recording your lien in California, or file one stress-free with Levelset at https://www.levelset.com/mechanics

Mechanics Liens in California: Overview + Requirements for Contractors & Property Owners 🏗️ – YouTube

Dec 18, 2023File the Lien. Depending on your state, you will need to file the lien with either the property recorder’s office or the clerk of court. If you are filing a lien on a property, it must be filed in the county in which the property is located. Most jurisdictions charge a filing fee between $25 and $50.

Source Image: pinterest.com

Download Image

A lien can be placed on a property by any party to whom the property owner owes money. This typically includes mortgage lenders, contractors, or government entities. When a lien is placed, the owner must pay off the debt to remove it and regain control of the property. Now, the point of lien is to gives creditors a legal way to get control over

Source Image: homelight.com

Download Image

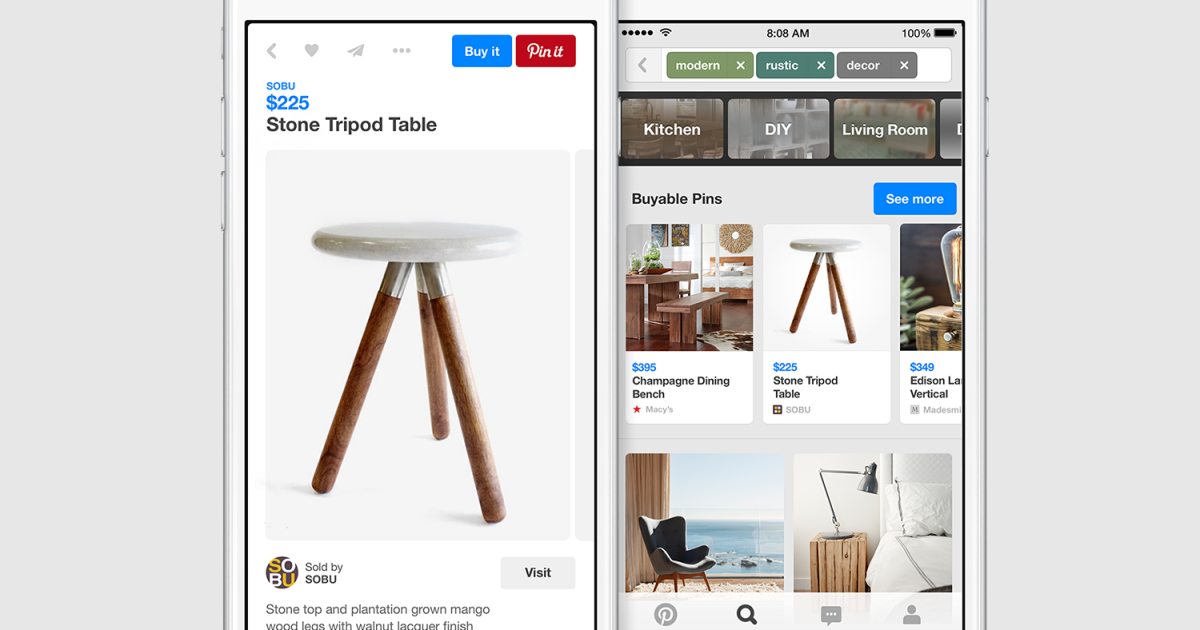

Pinterest users can now shop directly on the site with Buyable Pins – Los Angeles Times Notice of Lien. (AT-180) Tells the parties in a civil case that there is a lien against (a legal claim for) the property the case is about or what one of the parties might win in the case because there is an attachment on the property of that party or a decision by a court (judgment) that the party owes money in another case. Also tells the

Source Image: flyhomes.com

Download Image

How To Put Lien On Property In California

Notice of Lien. (AT-180) Tells the parties in a civil case that there is a lien against (a legal claim for) the property the case is about or what one of the parties might win in the case because there is an attachment on the property of that party or a decision by a court (judgment) that the party owes money in another case. Also tells the Oct 12, 2023In California, a judgment lien on real property lasts for ten years. This means that if a court has ruled in favor of a creditor and placed a lien on your property due to unpaid debts, that lien will remain for a decade. During this time, the creditor has the right to repayment from the proceeds of your property if it’s sold or refinanced.

Can I buy or sell a home with a lien on it? – Blog

When a small claims court judgment in California is not paid within 30 days, the plaintiff can file a lien on the debtor’s real property. Besides the amount awarded, the debtor must pay court fees incurred for the writ of execution, debtor’s examination and abstract of judgment, fees from the county recorder related to the abstract of judgment and sheriff fees. How to create a Pinterest worthy home

Source Image: loandepot.com

Download Image

Pinterest for brands : opportunity or fad? | PPT When a small claims court judgment in California is not paid within 30 days, the plaintiff can file a lien on the debtor’s real property. Besides the amount awarded, the debtor must pay court fees incurred for the writ of execution, debtor’s examination and abstract of judgment, fees from the county recorder related to the abstract of judgment and sheriff fees.

Source Image: slideshare.net

Download Image

Mechanics Liens in California: Overview + Requirements for Contractors & Property Owners 🏗️ – YouTube Watch this video to avoid common pitfalls when recording your lien in California, or file one stress-free with Levelset at https://www.levelset.com/mechanics

Source Image: youtube.com

Download Image

Pinterest users can now shop directly on the site with Buyable Pins – Los Angeles Times A lien can be placed on a property by any party to whom the property owner owes money. This typically includes mortgage lenders, contractors, or government entities. When a lien is placed, the owner must pay off the debt to remove it and regain control of the property. Now, the point of lien is to gives creditors a legal way to get control over

Source Image: latimes.com

Download Image

How to file a lien in California | Step 2: Serving & recording the lien – YouTube California law says that when a subcontractor starts work, she has to notify you of her right to file a lien. With a direct contractor, the notice is part of her contract with you. If the bills go unpaid, the contractor or sub sends you a notice along with her claim of lien. She then files the lien with the county within 90 days of the project

Source Image: m.youtube.com

Download Image

How to Place a Lien on a House or Other Property – Rocket Lawyer Notice of Lien. (AT-180) Tells the parties in a civil case that there is a lien against (a legal claim for) the property the case is about or what one of the parties might win in the case because there is an attachment on the property of that party or a decision by a court (judgment) that the party owes money in another case. Also tells the

Source Image: rocketlawyer.com

Download Image

When Does The Irs File A Tax Lien? Oct 12, 2023In California, a judgment lien on real property lasts for ten years. This means that if a court has ruled in favor of a creditor and placed a lien on your property due to unpaid debts, that lien will remain for a decade. During this time, the creditor has the right to repayment from the proceeds of your property if it’s sold or refinanced.

Source Image: anthemtaxservices.com

Download Image

Pinterest for brands : opportunity or fad? | PPT

When Does The Irs File A Tax Lien? Dec 18, 2023File the Lien. Depending on your state, you will need to file the lien with either the property recorder’s office or the clerk of court. If you are filing a lien on a property, it must be filed in the county in which the property is located. Most jurisdictions charge a filing fee between $25 and $50.

Pinterest users can now shop directly on the site with Buyable Pins – Los Angeles Times How to Place a Lien on a House or Other Property – Rocket Lawyer California law says that when a subcontractor starts work, she has to notify you of her right to file a lien. With a direct contractor, the notice is part of her contract with you. If the bills go unpaid, the contractor or sub sends you a notice along with her claim of lien. She then files the lien with the county within 90 days of the project